Hi Growth folks 👋

I hope you had a great Christmas break 🎅

With 2023 coming to an end, I wanted to take a look back at what happened this year and try to predict what will happen in 2024 in the Product & Marketing ecosystem, but also more largely for the Startup & Tech ecosystem.

Those predictions are based on my own experience of working in a big scale-up (BlaBlaCar), discussions with peers from other companies, a lot of content reading, and trends/data analysis. Some of them will probably be right, others will probably be false. So don’t take them as a truth, it’s a guess exercise that only reflects my own beliefs.

That being said, let’s go try to read in the future 🔮

1️⃣ The shift from “Hypergrowth” to “Profitable Growth” is here to stay in 2024

After a 2021-2022 period that could be described as a hypergrowth Covid rebound for the startup and tech ecosystem, due to low interest rates and aggressive investments, 2023 has clearly been a different year.

Inflation, high interest rates, and geopolitical events strongly impacted the tech ecosystem, leading to lower fundraising. We saw massive layoffs, iconic startups going bankrupt (WeWork being the most famous example), and a shift from a pure acquisition focus that turned to usage and retention.

In Europe, in 2023, the total capital invested amount in 2023 is 55% lower than in 2021:

Looking at 2021 and 2022, we can see that we talk more about outliers than a normal reference point. I don’t know if we’ll come back at those amounts of funding at some point, but it’s very unlikely that 2024 will reach those levels.

In the US, the trend is rather similar, with declining funding amounts in 2023, no matter the startup stage:

“Profitable Growth”, rather than “Hypergrowth”, is now the main objective for most startups (probably for the best). At least for 2024, I predict it will stay the major focus of the tech ecosystem.

Even if we see indicators of a potential economic rebound (S&P 500 is back at its highest, interest rates stopped constantly increasing and will likely decrease in the coming month, and inflation is lower than a few months ago), it looks like we are still far from a stable situation. I believe lessons from the 2021-2022 period have drastically affected how startups envision their Growth now. Founders know that it’s harder to raise funds currently, so they need to have a clear path to profitability.

In addition to that, the ecosystem is becoming more and more mature, with tech companies funded +10 years ago that have achieved hypergrowth already.

This affects how startups build their growth strategies and directly the job of growth people.

2️⃣ Revenue and Retention, rather than Acquisition, are the new metrics we’ll focus on as Growth People

While before the main objective of people working on Growth was, most of the time, to build aggressive acquisition strategies that scale, without looking that much at metrics like usage and retention, this has come to an end.

In 2023, a lot of Growth teams started to look more at retention and revenue when doing experimentations.

Focus of experimentations of Growth teams in 2023 vs 2022 👇

2024 will be the prolongation of this trend. Due to the difficult economic context we talked about before, companies need to work on making the most of their customers, by working on improving retention and revenue.

We’re now entering an era where the question is not anymore “How many customers can I acquire this year?”, but more “How can I maximize revenue by making the most of my new and existing customers?”

Ultimately, this makes Growth people focus on Revenue (global revenue, average revenue per user, CAC, LTV, Net revenue retention) and Engagement and retention (active users, core features engagement, average retention and frequency) metrics.

For Growth teams, it means building Loyalty programs, experimenting in product to maximize engagement, or iterating on pricing will be part of their 2024 objectives.

Maximizing acquisition will still be there of course, but not will not be the main/only focus. Having a full-funnel / 360 vision of how to grow a business is now a better superpower than only having a vision of how to generate the most possible leads.

3️⃣ AI and Low/No-Code will become key skills to master for Growth people

2023 has been the year of the AI explosion. Low/No-code, on the other hand, is not a “new” concept (already been introduced a few years ago and mainly documented), but it is now even more accessible because of the emergence of very powerful platforms, and, thanks to AI, basic coding capabilities that are more accessible to everyone. And the adoption of these techs is becoming massive.

In the Marketing Industry, we expect the AI market value to grow by 5x in the next 5 years.

Market value of artificial intelligence (AI) in marketing worldwide from 2020 to 2028(in billion U.S. dollars)

The emergence of these new techs gives more freedom to Growth people who were before dependent on their engineering team to ship new things.

It has never been easier to launch a product, design an experiment needing custom code, or build a new screen since no code and AI arrived.

Concretely, it means that Growth people with strong skills in AI and Low/No-code can have more impact when working solo or with limited resources.

It will be a particularly strong skill to master for people working in Early-Stage startups or Freelancers, who will be able to ship fast with limited to zero developers to help them.

For Growth teams working on later-stage startups, with dedicated engineering resources, AI and No-code will for sure help them too to progress faster and in a leaner way.

At the pace AI tools are currently developing, we’ll see for sure in 2024 amazing tools and applications of AI for Growth emerging.

From building copies and creatives to automating complex processes, passing by creating custom code to optimize an onboarding funnel UX, the possibilities are endless.

4️⃣ Growth people will need to become more and more product-oriented, due to the rise of Product-led Growth and the decline of traditional sales-led models

For a few years now, Product-Led Growth has been rising. And that means Growth people need to learn new skills, more product-oriented than sales-oriented.

In a nutshell, Product-Led Growth is a model that positions the product as the main driver of growth, retention, and revenue, with key traits like:

Self-serve model, easy to try the product.

Freemium or Free trial business model.

Strong focus on engagement and retention.

Products built to become viral.

→ Growth people will need to master the technics to drive through the product rather than with marketing campaigns.

Those tactics can be:

Building efficient onboarding funnels to increase activation and engagement.

Creating lifecycle CRM sequences focusing on creating strong usage, but also detecting when it’s the right time to upsell by pushing paid plans. The focus will be on having PQL (product-qualified leads) rather than SQL (sales qualified leads) or MQL (marketing qualified leads).

Optimizing paywall conversion, to make the most revenue out of your current user base.

For many growth people who are working in more traditional sales-led companies, where the focus is on generating leads for sales, this is a massive shift of tactics and skills needed.

And mastering Low/No-code and AI will help when an experiment on the product is necessary.

5️⃣ B2B brands will adopt more and more B2C codes and less rely on Cold Outbound

Lead generation through outbound channels (cold email, Linkedin…) was a cornerstone of growth for many companies but is becoming less efficient:

73% (!) of SDRs aren’t hitting quota (Operatix and Pavillion).

Only 24% of sales emails get opened, and 9% get responded (Rightinbox).

The majority of marketers tend to acknowledge Outbound is becoming less efficient.

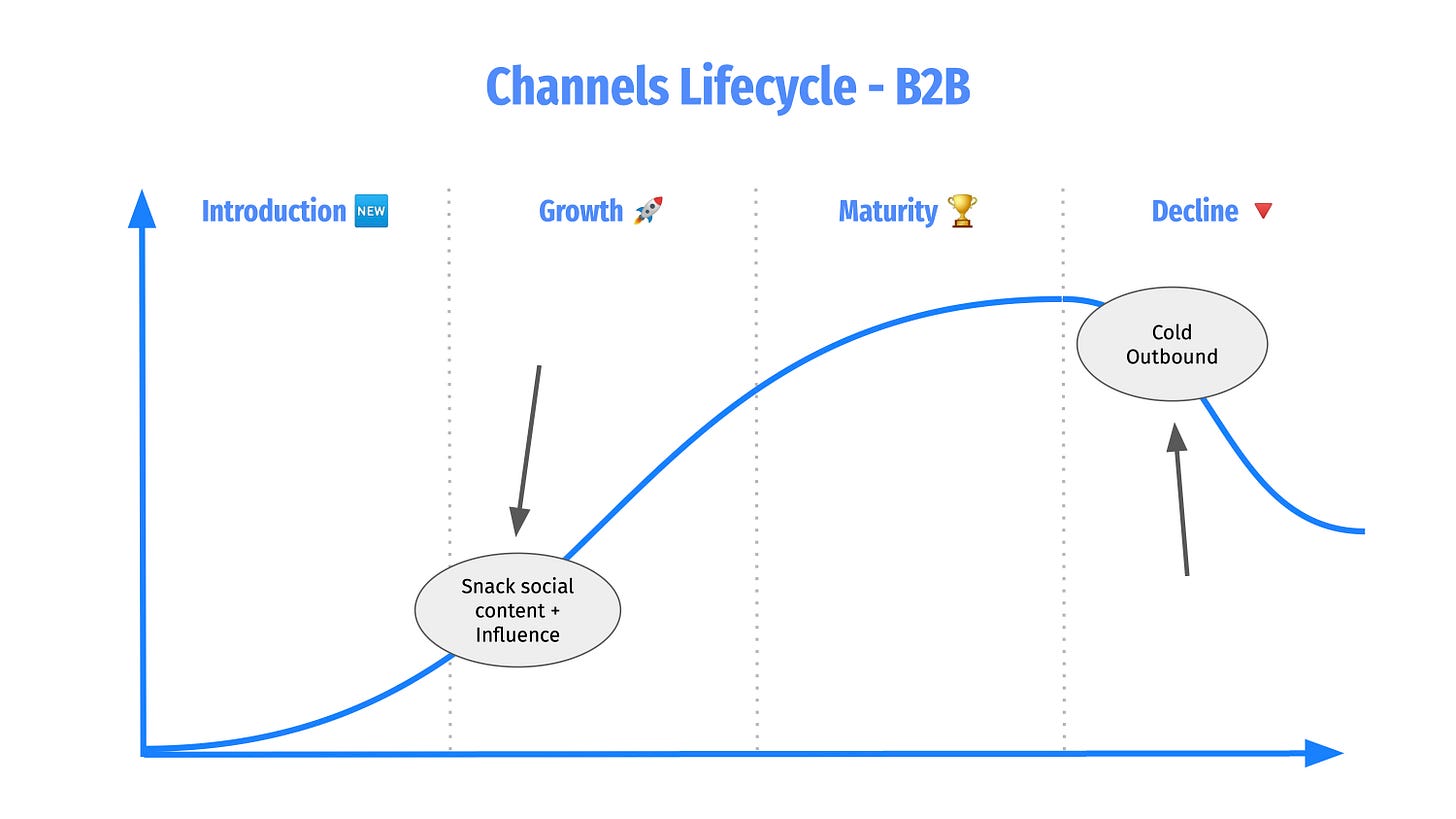

And that’s normal. This phenomenon happens to every channel. At some points, too many companies have used a channel and it becomes saturated.

“Over time, all marketing strategies result in shitty clickthrough rates.”

Andrew Chen - The Law of Shitty Clickthroughs

On the other hand, we see channels like snack content on social media (short videos, Reels/Tiktok format), longer video content pushed by founders (vlogs, build in public) and partnerships with B2B influencers (mainly on Linkedin and YouTube from what I saw) becoming more and more important.

My vision is that Snack's social content and Influence in B2B are starting their growth phase, while Outbound has started its decline probably 1-2 years ago.

It means the timing to start implementing those strategies to generate and capture demand is great. The momentum is here. And I believe a lot of great B2B brands understand it and will double down on those channels in 2024.

At the end of the day, whether you’re in B2B or B2C, you’re selling to humans who scroll on Instagram during their commute.

So B2B businesses can learn a lot from B2C ones and start testing and implementing those more “modern” channels in their acquisition mix.

However, it’s still important to take into account that volumes, average revenue per customer, CAC and LTV are generally very different in B2B vs in B2C. So each B2B business entering a new channel should carefully look at whether this channel suits their model or not.

And that’s a wrap for today folks! I hope you liked this edition.

Rendez-vous at the end of 2024 to see how things have evolved and if those predictions were right 🫣

And you, what are your top predictions for 2024? Share them in the comments on Substack 💬

I love all these predictions. 2024 will be fun!