Hunter Growth Story: How to reach 4 million users in a crowded Market

🎙️ Ft. Greg d'Aboville, Hunter ex-head of Marketing

Hey Growth Folks 👋

I’m pleased to introduce the first edition of Growth Stories: a series of articles where I deeply research Product-Led companies' growth strategies, by interviewing the people who built them.

For this first edition, I had the honor to interview Greg d’Aboville, who was the Head of Marketing of Hunter from September 2022 to April 2024. He worked on the full customer lifecycle, from Acquisition to Monetization.

Hunter is an all-in-one email outreach platform that helps you find and connect with the people that matter to your business.

Created in 2015, Hunter has achieved amazing results:

4+ million users, including leading companies like Microsoft, Adobe, or Canva

∼ 300,000 SEO visits per month

∼ 70,000 sign-ups per month

But the path to reaching those numbers has not been easy. Over the past few years, the email outreach market has become increasingly competitive, and Hunter has made some drastic product and growth changes to continue being successful.

Greg has delivered high-quality advice and insights on how they’ve made it.

Let’s discover them 🚀

1# Hunter Early Days: A Famous Email Outreach Tool Was Born

Hunter was founded in 2015 with the vision of simplifying the process of finding professional email addresses.

The idea was to create a tool that was effective and easy to use for sales and marketing people.

Hunter is one of the first tool I used when I started working in Growth in 2019. At the time, I was working in an early-stage B2B startup and we were entering the market by relying a lot on outbound.

To do email outreach, we needed to…find verified emails. And Hunter was perfectly positioned as an innovative product at this time.

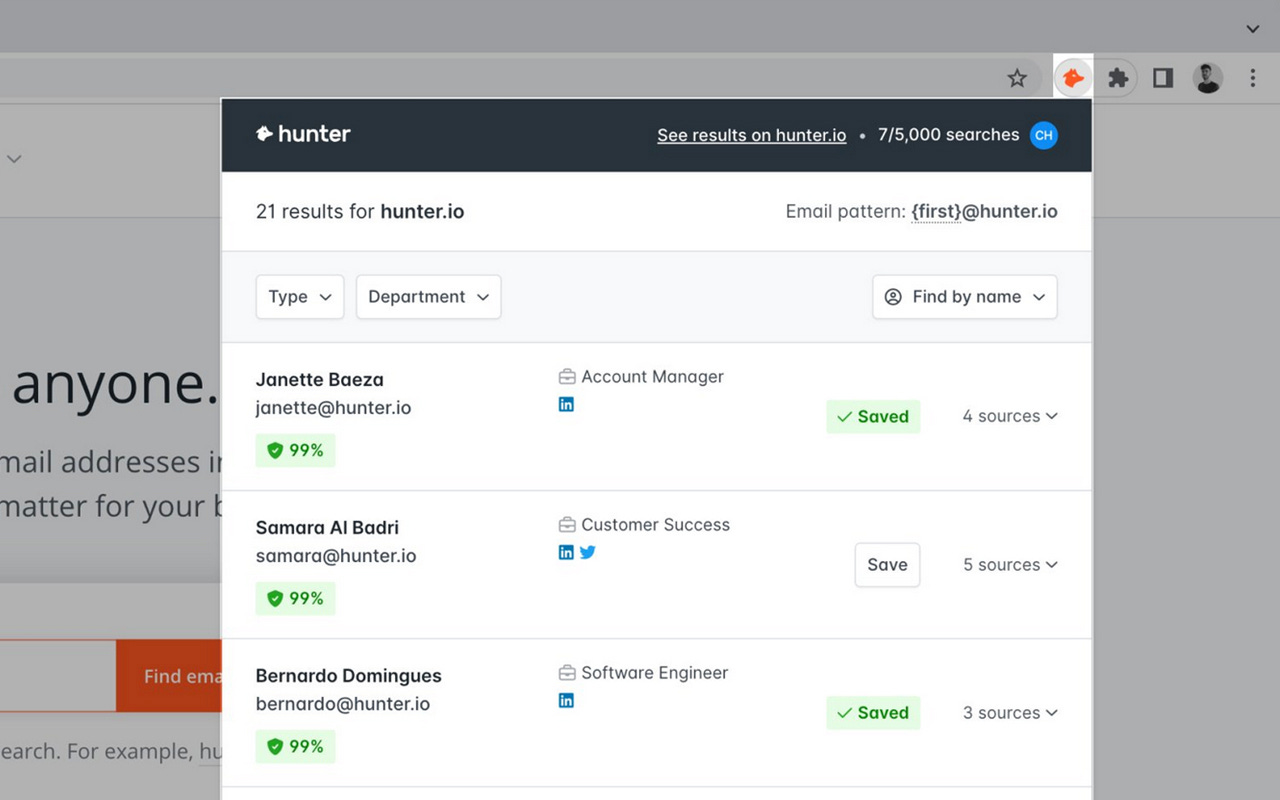

They had launched their “Email Finder” feature, which finds verified emails based on a company domain name and a first & last name or guess probable ones.

You could then verify those emails with their “Email Verifier” feature.

In the early days, Hunter capitalized on several elements to grow:

Innovative Product: While email finders/verifiers are pretty common products on the market now, Hunter was a real innovation at the time. The market was booming and Hunter was one of the first solutions to allow people to solve this need.

Strong Product/Market Fit: 2015-2020 was a period where cold email outreach was strongly rising, thanks to automation and tools like Hunter. All people working on outbound needed to find verified emails. And Hunter was perfectly solving this need.

Product-led Growth model: Hunter started with (and still has) a freemium, self-serve model, where the product is the main growth driver. The time to value is short: in just a few clicks, you can find and verify the email of a person you want to contact, without payment and long onboarding needed. Reducing friction is a big advantage. While many SaaS companies are now product-led growth, Hunter was part of the precursors to adopt this model in B2B.

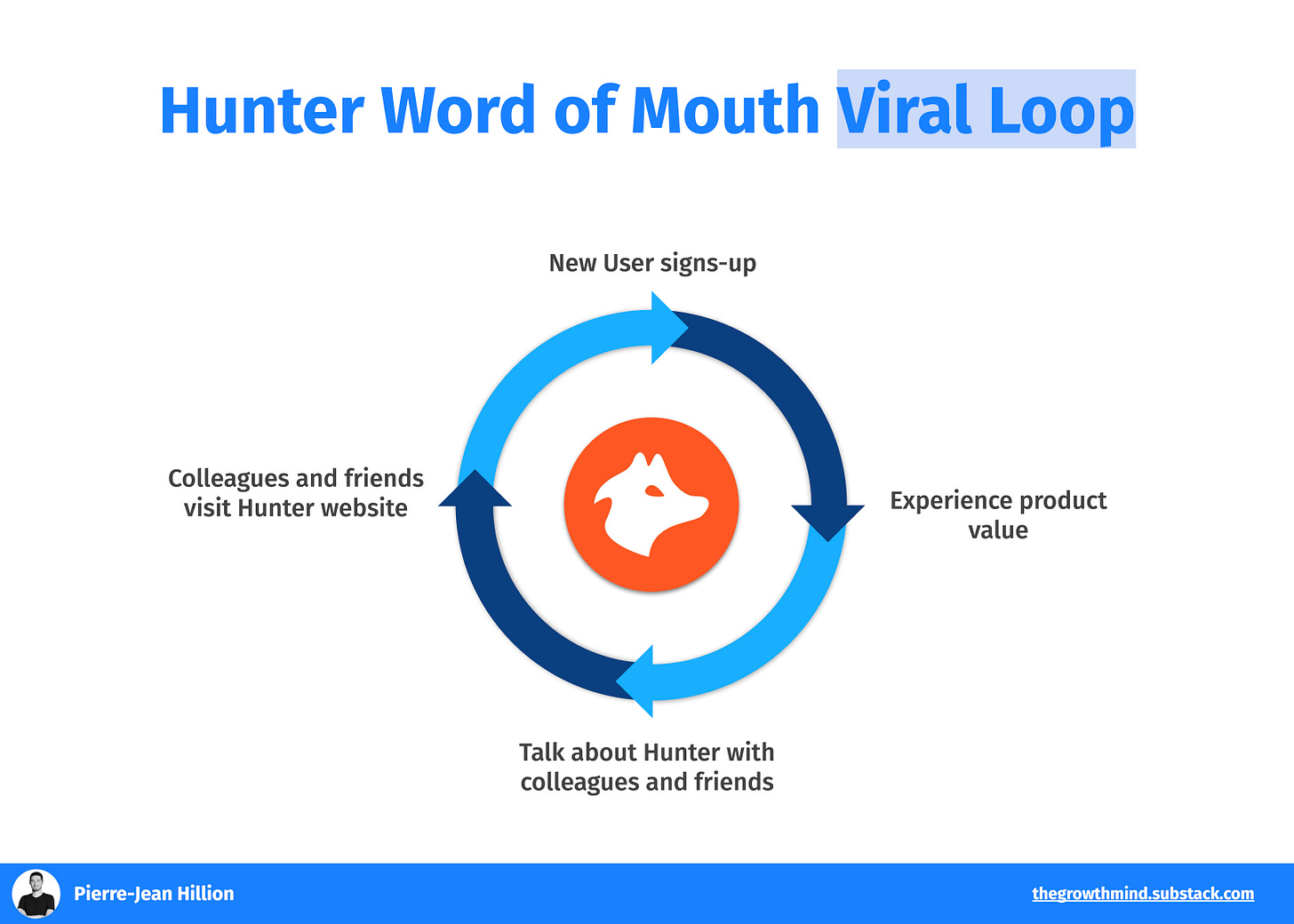

Word-of-mouth Viral Loop: A great product, that solves a real need, without friction, is perfectly designed for virality. Especially in the sales & growth ecosystem, where the community loves to talk about new tools. Then, Hunter benefited a lot of awareness because a lot of people were talking about them.

Inbound Marketing & SEO: On top of all those elements, Hunter also worked on an inbound marketing motion, leveraging different content formats like Webinars, Customer stories, Templates, or Outreach Guides. This type of content helped to increase their brand awareness and authority over time, while also helping a lot to be well positioned on Search Engines. For example, they rank as the 1st organic result on email finder and email verifier keywords on Google.

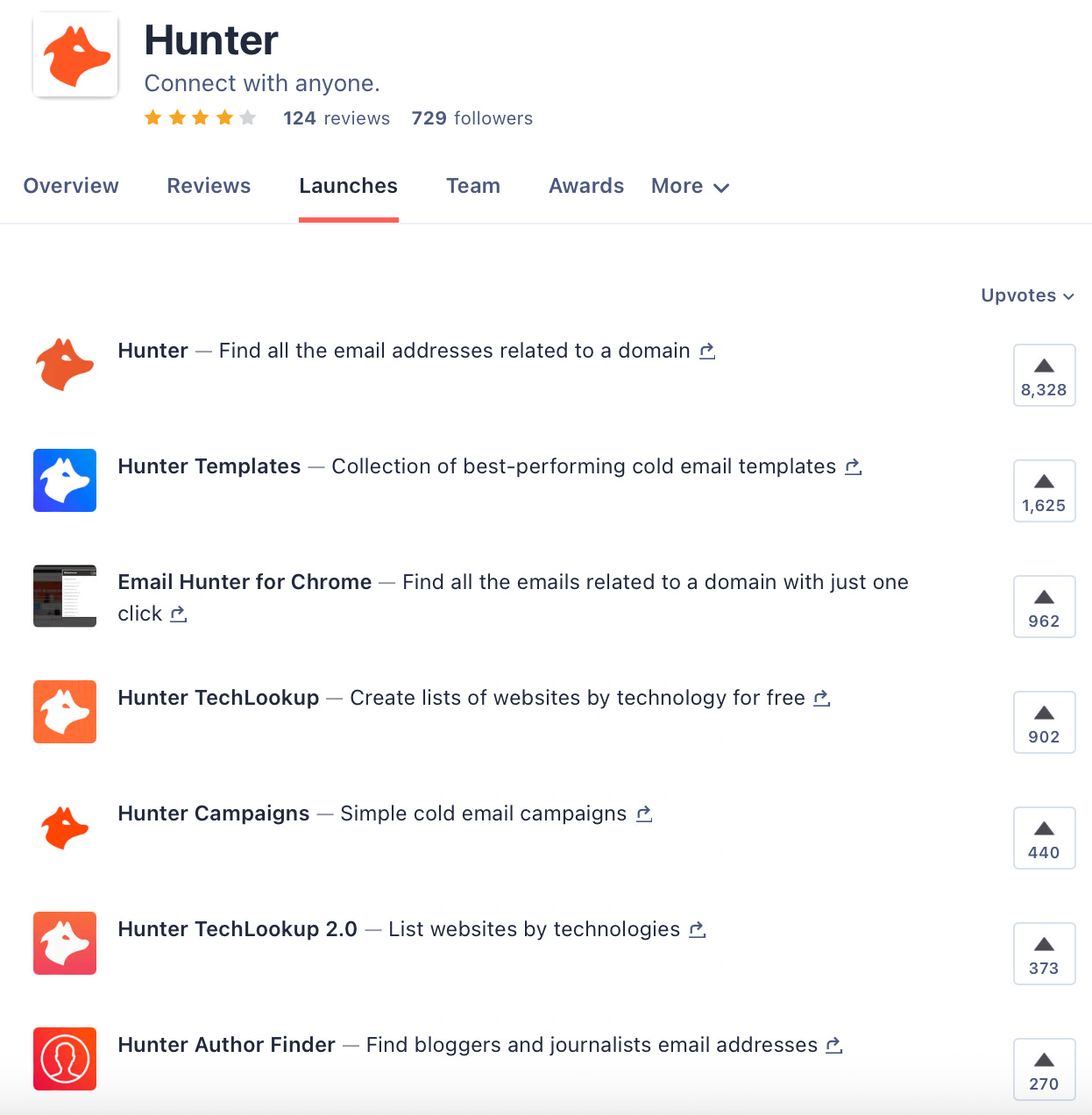

Product Hunt: Hunter made several Product Hunt launches over the past few years, either around their main product or new features. During their first launch, in April 2015, they got +8.3k upvotes and were named 1st Product of the Day, Week, and Month! At the time, it has been a key lever to drive traffic to the platform.

2# The Saturation of the Email Outreach Market: Hunter's Main Challenge Recently

While Hunter entered the market as a truly innovative player, it became less the case over the past few years. The email outreach market drastically evolved and became increasingly competitive due to the entrance of new players.

2015-2016: Early Growth and Adoption

The emergence of the first tools: Key players like Clearbit and RocketReach entered the market, focusing on basic email finding and verification. Hunter was part of this phase, being an early player.

Initial Adoption: Early adopters began using these tools to streamline their outreach processes and find accurate contact information. It was the early days of the market, where only a small portion of sales & growth people started using these tools.

2017-2018: Expansion and Feature Development

Increased Competition: More competitors like Voila Norbert, Snov.io, and Lusha emerged, leading to a more crowded market.

Feature Enhancements: Players began adding advanced features such as email automation, drip campaigns, and CRM integrations. The focus shifted towards providing more complete solutions, solving several needs of the email outreach process, rather than having one or two simple features.

Regulatory Compliance and Privacy Rise: The introduction of GDPR in 2018, coupled with the increasing demand for tools respecting privacy, prompted players to be more transparent in their approach, especially for signing enterprise deals.

2019-2021: Personalization and Automation

Rise of Personalization: Tools like Lemlist gained popularity by offering personalized email outreach features, including video emails and personalized images with prospects’ information.

Advanced Automation: Integration of sophisticated automation capabilities, such as scheduling follow-ups and creating complex email sequences, became standard.

Continuous Market Growth: The email outreach market continued to grow, driven by the increasing adoption of email in B2B marketing.

2022-Present: Data-Driven Insights and AI Integration

AI and Intent Data: The rise of automation in cold outreach, largely adopted now, led to decreasing outreach performances. Companies like Apollo.io and Hunter.io (with Hunter Signals -we’ll dive into it later) started leveraging AI and intent data to have a better targeting, based on real intent data, and lead scoring.

Enhanced Analytics: Tools began offering advanced analytics and reporting features, providing deeper insights into campaign performance.

Innovation and Consolidation: Ongoing innovation in AI, machine learning, and data analytics continues to drive market evolution. The market also saw some consolidation as larger players acquired smaller companies to expand their capabilities.

In this context, Hunter has been heavily challenged by other players. And they still managed to continue being competitive and growing. But how did they do it?

3# The Product & Growth Strategies Towards Hunter 4+ Million Users

A. Build the growth foundations

Greg was the first hire of Hunter with a growth background.

And when he joined, the company had only a limited visibility of its growth funnel.

To better understand where the company needed to focus, Greg started by creating a robust analytics and reporting setup.

After studying Segment, the team settled on a quicker and cheaper option: creating a copy of the database in BigQuery and enriching it with new properties and events.

This allowed Greg to measure the AARRR metrics for the company effectively.

B. Pick the low-hanging fruits

Once the reporting was ready, the Hunter team was able to identify some quick fixes:

The conversion rate of the website could be increased by requiring a broader share of visitors to create an account

→ Result: +57% in signupsThe account validation process could be smoothened for some users

→ Result: +9% of users could verify their account and effectively use the productThe delinquent churn could be reduced by restricting quicker accounts with a payment issue and by improving the communication with the associated users

→ Result: -30% in delinquent churn

These reports also helped the team identify that besides the email finder and the email verifier, some of the Hunter products had a very low adoption among its users.

C. Build a long-term product roadmap

No marketing strategy will fix a product that is no longer competitive and appealing to its target audience. To keep a strong product/market fit, Hunter also needed to innovate.

First, the team focused on Hunter’s core product, the email finder. As most users compare email finder tools by comparing their valid email find rates, the team made it a priority to increase this KPI. Within 6 months and with the help of AI and core algorithm updates, the team increased the valid find rate from around 30% to 35%, placing Hunter back among the top 3 email finder tools.

Then the team changed its focus to Campaigns, Hunter’s cold email tool. Greg led 30 user interviews to identify the key features to implement to grow its adoption among Hunter users. These discussions allowed the team to shortlist a few options that would remove some friction and grow the capabilities of the tool. Once the roadmap for this feature was ready, he started investigating which other features could bring additional activity and revenue to the company.

To do so, Greg proceeded like this:

Users Interviews: He led the efforts to understand what were the main challenges of Hunter target audience through detailed interviews, asking questions about their KPIs, challenges, and what solutions they envisioned. The important point he mentioned was to not only talk with Hunter customers but also to talk with prospects or people using competitors. It gave him a clearer, non-biased view of what was needed to attract new customers to Hunter and retain existing users. The interviews made it clear that the main struggle of Hunter users was to source new relevant leads quickly. This idea became a new feature: Signals.

Launch Hunter Signals as a standalone product: the team launched Signals as a standalone product to validate the concept of using intent data to find potential customers. They did not want to integrate it as a main product feature before validating there was a real need. After proving product-market fit, it was integrated into the core Hunter product.

Deploying Signals as a core product feature (Beta): Hunter Signals rapidly gained 1,000 users within three months of its launch, primarily through internal promotion channels (popups, emails, etc.). The feedback they received from those users, coupled to great user retention, gave them sufficient confidence to prove this new product had a great market fit. Now, Signals is fully integrated into Hunter's main product as a Beta feature and part of their global value proposition.

D. Strengthen the adoption of the new and existing features

Once the revamped features and Signals were live, the team noticed that adoption was still lagging. Then came a fourth phase focused on product marketing.

The team listed all the communication channels at their disposal and drafted a product marketing strategy.

Soon, they implemented the following promotion elements:

Event-triggered emails to promote related features. For example, when a user found their first 5 emails, the cold email feature was suggested.

Contextual calls-to-action. For example, an option to add new emails found to a cold email campaign was added.

Event-triggered popups within the product. For example, each new user has displayed a banner inviting them to test Signals.

The team also invested strongly in promotion content:

New blog articles focused on features promotion.

Webinars explaining how to get the most of Hunter’s new capabilities.

A cold email guide.

Combined, these efforts helped multiply the number of Campaigns users by 13.

They were also instrumental in attracting new Signals users.

And that’s all for today folks! 👋

Again, a big thanks to Greg who has delivered top-notch insights about Hunter Growth Story. You can follow him on LinkedIn here.